This post is part of my ongoing “Get Fit” series, an effort to lose a little weight/tone up, and save money by reducing the number of meals I eat out.

I officially started this series on November 20, and want to give you an update as to how it has impacted my financial life.

First, let me backtrack a bit.

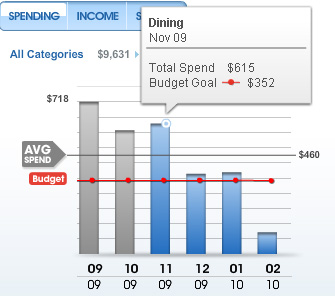

In late November I decided to start tracking my eating out expenses using FinanceWorks, a great money management tool provided through my credit union. When I saw that I’d spent $718 eating out in the month of September I nearly fell out of my seat… and I’m dumbfounded by simply typing that figure.

The amount dropped a bit in October, and in November I still managed to spend $615 eating out, which is still an insane spending level for a single guy that doesn’t drink alcohol. Thankfully in November I started the “Get Fit” series and really became committed to eating out less and getting in shape.

Note: Keep in mind that I ran for political office last year and was hardly ever at home – one of the many reasons I ate out so much.

As you can see by looking at the chart above, I have nearly cut my eating out expenses in half since September. I currently budget $350 a month for eating out, and have gone over just a bit the last two months, but I’m committed to hitting the goal in February (one out of town trip might mess that up slightly).

If you consider $350 a month a lot for eating out, keep in mind that I only budget around $200 for groceries. My lifestyle simply doesn’t permit me to eat at home every night (three to four nights a week at best).

So, is the “Get Fit” series helping me accomplish my goal of toning up and saving money? Absolutely.

Thanks for reading and I hope you find this series to be helpful.